Инвестируйте выгодно свои средства и получайте высокий доход!

- от 1 000 рублей

- от 15,00% годовых

- покупка коммерческих облигаций с возможностью досрочного погашения (оферты)

Инвестируйте в надёжного эмитента!

Рейтинговое агентство «Эксперт РА» 07 июля 2020 года присвоило факторинговой компании ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» рейтинг кредитоспособности на уровне «ruВ» со стабильным прогнозом.

25 июня 2021 года рейтинговое агентство «Эксперт РА» подтвердило рейтинг кредитоспособности факторинговой компании ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» на уровне «ruВ» со стабильным прогнозом.

06 июня 2022 года рейтинговое агентство «Эксперт РА» подтвердило рейтинг кредитоспособности факторинговой компании ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» на уровне «ruВ» со стабильным прогнозом.

26 мая 2023 года рейтинговое агентство «Эксперт РА» повысило рейтинг кредитоспособности факторинговой компании ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» до уровня «ruВ+» со стабильным прогнозом..

На данный момент ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» – первая в России независимая федеральная факторинговая компания, которая в современных условиях получила, подтвердила и затем повысила действующий официальный кредитный рейтинг.

В качестве позитивных факторов рейтинговое агентство отметило высокую эффективность бизнеса, высокий уровень диверсификации ресурсной базы, приемлемую ликвидную позицию, отраслевую диверсификацию клиентов и дебиторов, адекватное качество факторингового портфеля и уровень корпоративного управления. Финансовое положение компании оценивается агентством как стабильное.

Ключевые показатели

Инвестируйте в удобной цифровой OTC-системе ММВБ

Московская Биржа значительно усовершенствовала услуги для работы инвесторов и брокеров с коммерческими облигациями. Ранее участники рынка должны были самостоятельно заполнять поручения на клиринг DVP в Национальном расчетном депозитарии (НРД) - теперь данные для поручения направляются в НРД автоматически после заключения цифрового соглашения в ОТС-системе долгового рынка Московской Биржи (MOEX board), что позволяет существенно снизить операционные риски, повысить расчетную дисциплину и ускорить обмен информацией между участниками рынка. Новая цифровая схема работы радикально упрощает расчёты по ценным бумагам и ведет к качественному росту рыночной ликвидности и доступности коммерческих облигаций для целей инвестирования.

Работу с коммерческими облигациями ООО «ГЛОБАЛ ФАКТОРИНГ НЕТВОРК РУС» в ОТС-системе долгового рынка Московской Биржи обеспечивает наш стратегический Партнёр, одна из ведущих и надежных инвестиционных компаний на рынке – Инвестиционная Компания «РИКОМ-ТРАСТ». Оставить заявку на покупку облигаций и получить весь спектр необходимых брокерских услуг можно пройдя по активной ссылке https://www.ricom.ru/stock_store/.

Почему коммерческие облигации выгоднее депозитов

| Параметры сравнения | Облигации | Депозиты |

| Доходность | от 15,00% годовых | средняя ставка 8,95% годовых |

| Налог на доходы физических лиц(НДФЛ) | НДФЛ - 13%Удерживается Депозитарием, избавляя Клиента от дополнительных трудозатрат.При использовании ИИС типа Б весь купонный доход от облигаций может быть освобожден от НДФЛ | НДФЛ - 13%Уплачивается Клиентом самостоятельно.Начисляется ежегодно на сумму дохода по вкладу, превышающую 42,5 тыс. руб. |

| Сроки вложений | от 6 мес. | от 1 мес. |

| Процедура заключения сделки | Открытие счета депо в Депозитарии для хранения облигаций и заключение договора купли-продажи. Возможен электронный документооборот. | Заключение договора на открытие вклада. |

* На этом счете учитываются права на ценные бумаги, принадлежащие депоненту.

Алексей Примаченко

Управляющий партнер

Global Factoring Network

Наша Компания представляет собой команду профессионалов, работающих в области предоставления факторинговых услуг с 2004г.

За время нашей работы накоплен значительный опыт, который позволяет успешно реализовывать все перспективные направления для развития Компании.

Одним из таких направлений является возможность выпуска коммерческих и биржевых облигаций на выгодных условиях, позволяющих получать высокий доход для инвесторов, в том числе среди широкого круга населения, как выгодная альтернатива классическим банковским депозитам

Преимущества

Доход выше

банковских депозитов

Персональный

менеджер и аналитик

Индивидуальный

подход к каждому Клиенту

Достаточно всего 3 простых шага, чтобы стать успешным инвестором!

1 шаг

Консультация менеджера

В удобное для вас время мы организуем встречу у нас в офисе или приедем к вам

2 шаг

Оформление сделки

Заключаете договор на покупку ценных бумаг

3 шаг

Получайте свои проценты

Мы работаем, а вы получаете пассивный доход

Клиенты Global Factoring Network

Постоянными клиентами эмитента являются более 70-ти надежных Компаний

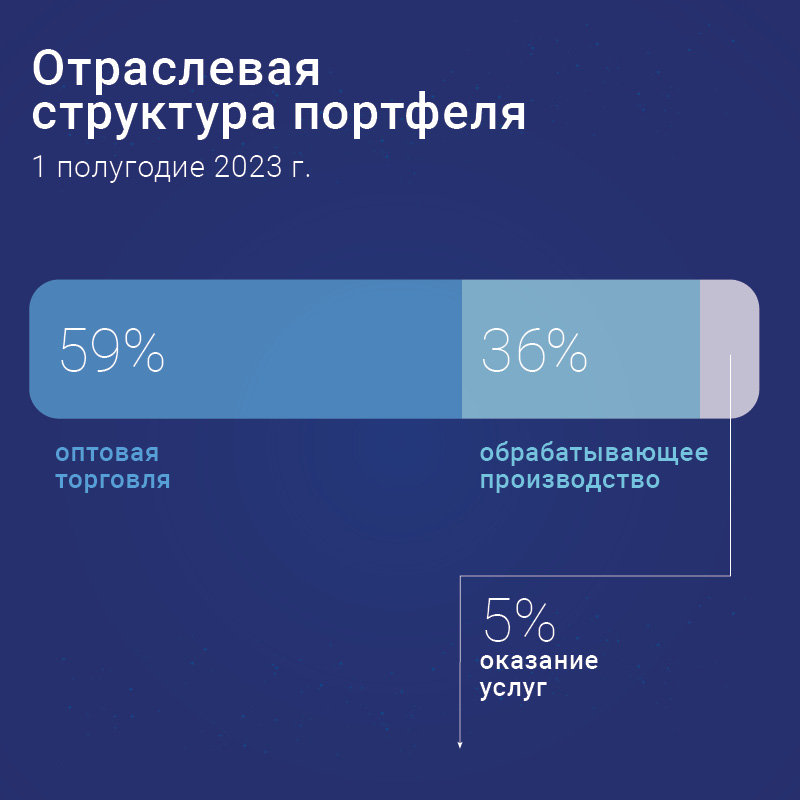

В основном Компания Global Factoring Network сотрудничает на постоянной основе с крупными системообразующими производственными предприятиями, федеральными сетевыми ритейлерами, транспортными компаниями, которые зарекомендовали себя как надёжные и динамично развивающиеся компании федерального масштаба.